Prof Dr. Jyoti Rattan PARTNERSHIP & LLP 3rd edn. 2024

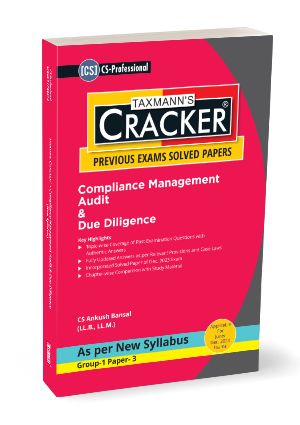

CS Professional Compliance Management Audit & Due Diligence (CMADD/Due Diligence) | CRACKER as per new syllabus for june and dec. 2024 exams

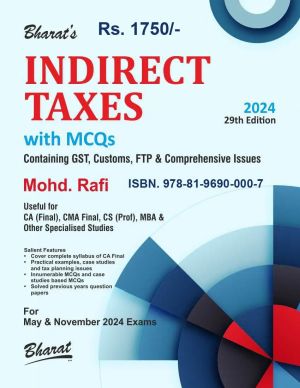

Bharat CA Final Indirect Taxes Containing GST, Customs, FTP & Comprehensive Issues With MCQ For New Syllabus By Mohd Rafi Applicable for May / November 2024 Exam

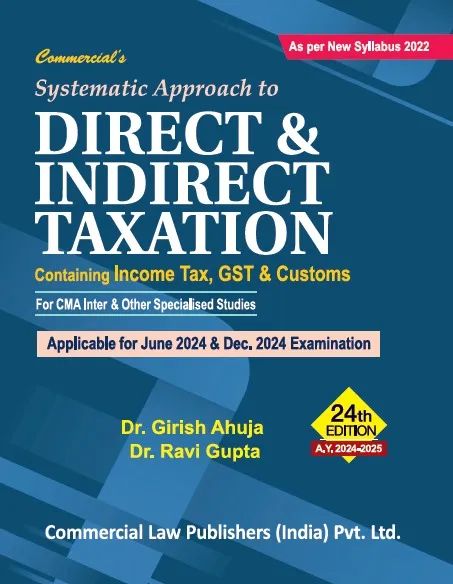

Commercial CMA Inter Systematic Approach to Direct & Indirect Taxtion By Girish Ahuja , Ravi Gupta Applicable for June / December 2024 Exam

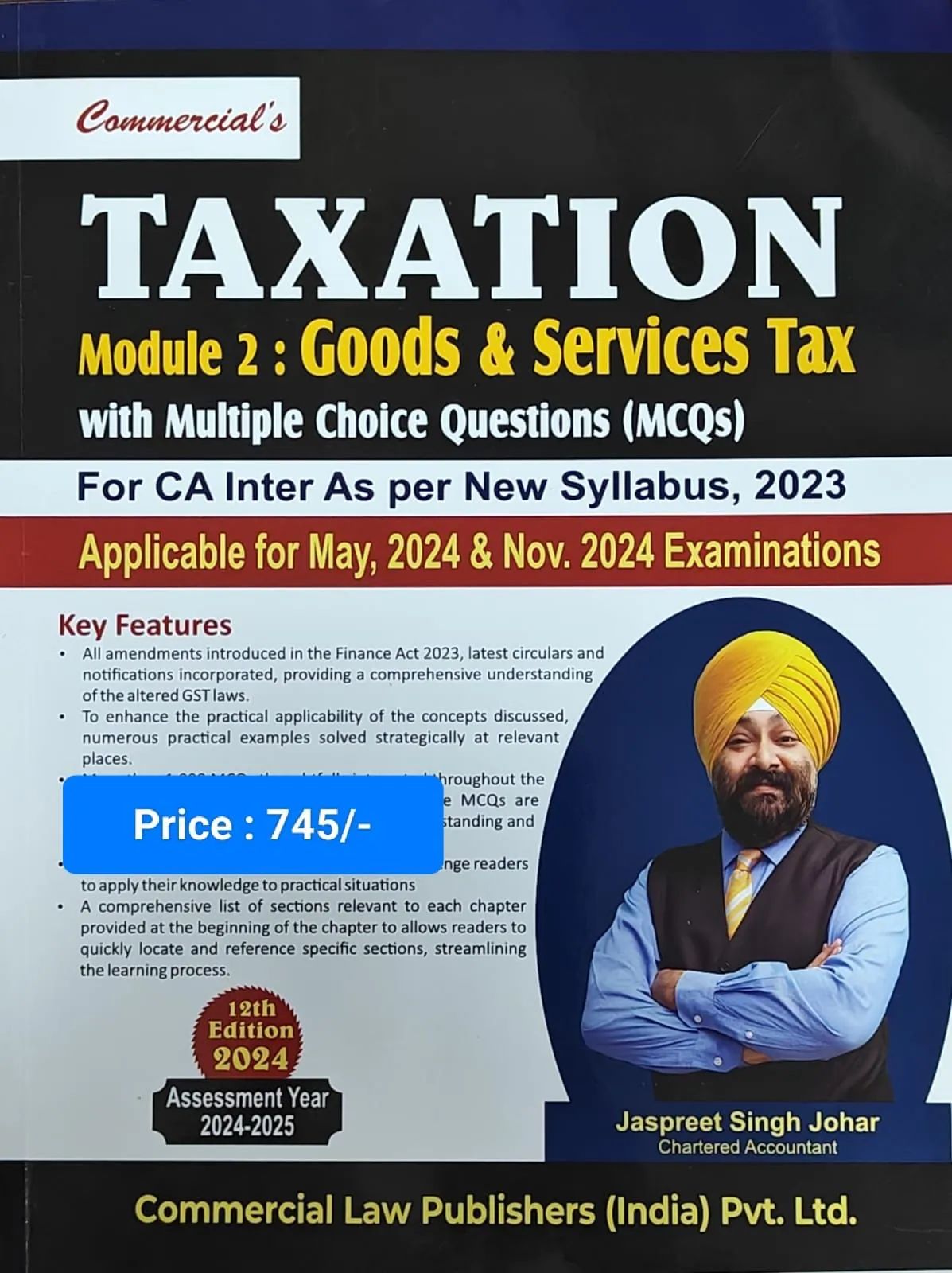

CA Inter Taxation Module 2 (GST) With MCQs New Scheme By CA Jaspreet Singh Johar Applicable for May / November 2024 Exam

Commercial Handbook on SEBI (LODR) Regulations 2015 By Corporate Professionals Edition 2024

CA Kamal Garg P M L A - Handbook for Reporting Entities edn. 2023 pmla

Ram Dutt Sharma Interpretation of Words and Phrases of Taxing Statutes Edn. 2024

Taxmann CS Professional Cracker Environmental Social Governance (ESG) | Principles & Practice New Syllabus By Ankush Bansal Applicable for June 2024

Taxmann Cracker CS Professional Resolution of Corporate Disputes Non-compliances & Remedies By Atul Karampurawala Applicable for June 2024 Exam

CHAMPIONING CS DREAMS by CS Shreshthi Surana edn. 2024

STANDARDS ON AUDITING - A PRACTITIONER’S GUIDE by CA. Kamal Garg edn. 2024