Ghanshyam Upadhyay GST Rate Finder on Goods 1st edn. 2021

Price:

1260.00

1000.00

CA Inter Taxation By Dr Girish Ahuja Dr Ravi Gupta May 2025 Exam

Price:

1599.00

1300.00

Systematic Approach to GST including MCQs for CA Inter 8th edn.

Price:

735.00

600.00

CS Professional Cracker Advanced Tax Laws Pratik Neve Applicable for December 2023 Exam

Price:

695.00

600.00

Taxmann CA Final Financial Reporting Made Easy Study Material By Ravi Kanth Miriyala and Sunitanjani Miriyala Applicable for November 2023 Exam

Price:

1150.00

950.00

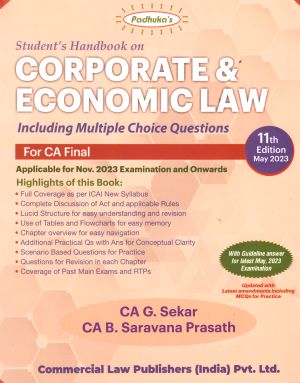

Students handbook on Corporate and Economic Law for CA Final new syllabus edn. may 2023 including MCQs

Price:

1348.00

1150.00

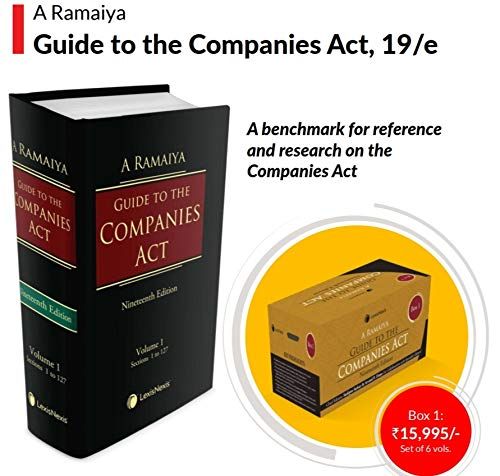

Guide to the Companies Act 19th Edition 2020 (Set of 6 Volumes)

Price:

15995.00

13595.00

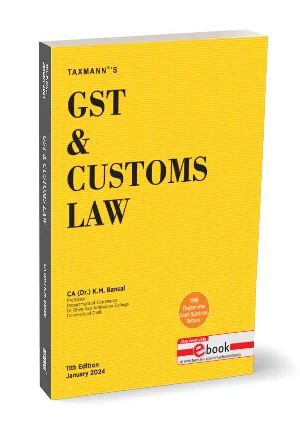

Taxmann GST & Customs Law B.Com. (Hons.) By K.M Bansal Edition 2024

Price:

795.00

650.00

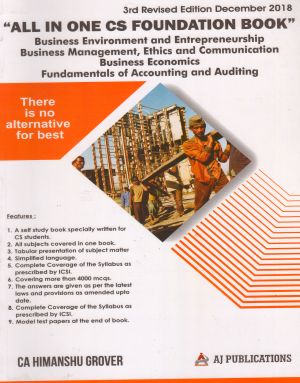

All in One CS Foundation Book 3rd edn. december 2018

Price:

625.00

475.00

GST Made Easy 1st edn. 2018

Price:

1485.00

CA Intermediate EIS Rocks

Price:

500.00

Shuchita Solved Scanner CA Final Paper - 5 Indirect Tax Laws for Sep 25 , Jan 26 and May 26

Price:

465.00