Taxmann Foreign Contribution Regulation Manual Edition 2024

Taxmann Money Laundering Law Manual Edition 2024

CA Vinod Gupta Direct Tax The Question Book covering last 33 years questions with their answer as per Finance Act 2023 assessment year 2024-25

CA Inter Goods & Service Tax (IDT) Book New Syllabus By CA Arpita Tulsyan Applicable for May / November 2024 Exam in 2 vols

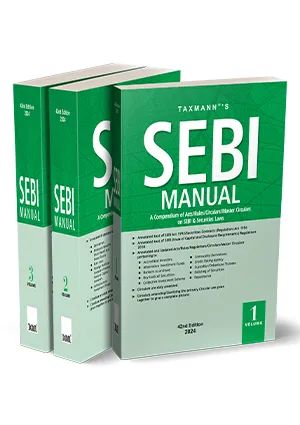

Taxmann SEBI Manual (Set of Three Volumes) Edition February 2024

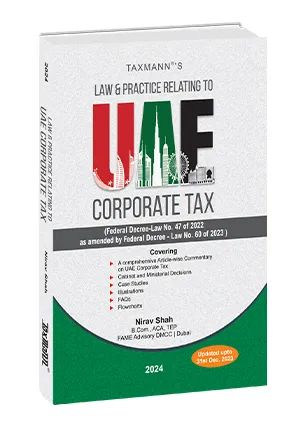

Taxmann Law & Practice Relating to UAE Corporate Tax By Nirav Shah Edition 2024

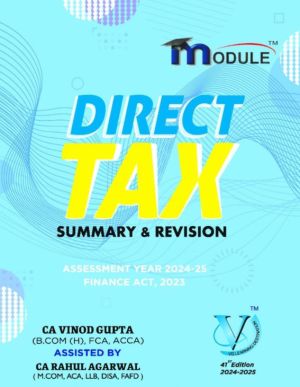

CA Final Direct Tax Summary and Revision Module New Syllabus By Vinod Gupta Applicable May 2024 Exam

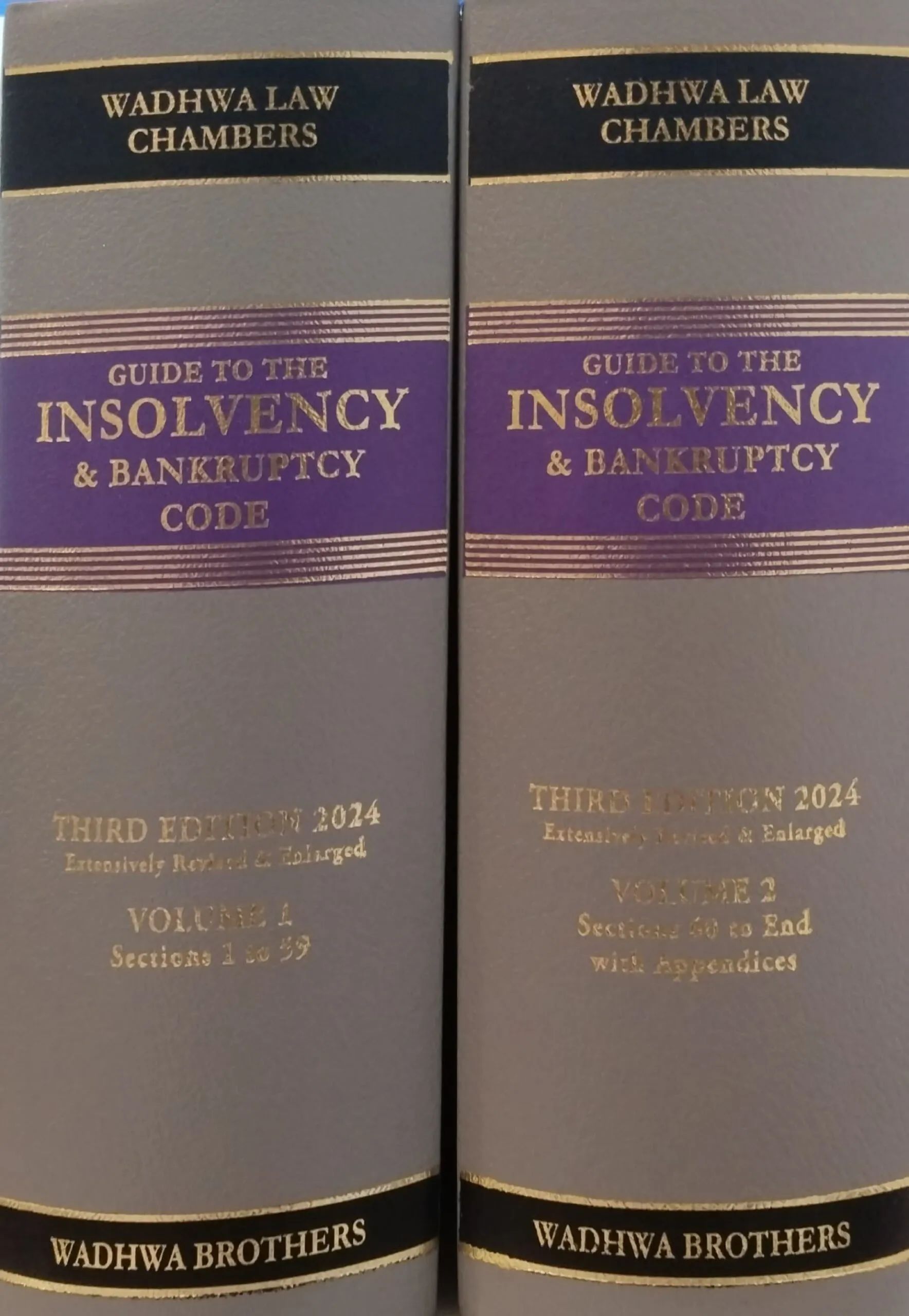

Guide to Insolvency and Bankruptcy Code 2 Vols 3rd Edn 2024

MakeMyDelivery Combo CA/CMA Final COMPACT & Q/A Compiler Direct Tax New Scheme By CA Bhanwar Borana Applicable For May/June & Nov/Dec 2024 Exams

CA Final Audit Notes (New Scheme) By CA Shubham Keswani Applicable For May / November 24 Exam

CA Final Financial Reporting Digest Concept Book & Question Bank (Set of 4 Volumes) New Scheme By CA Aakash Kandoi Applicable for May / November 2024 Exam

CA Inter Audit Notes New Scheme By CA Shubham Keswani Applicable May 2024 Exam