+91 40 2474 2324 +91 40 2474 2324

Advance Search

CA Books

CA Arpita Tulsyan Hand Written Book on Company Law , Economic Laws Self Placed Online Module Set A and Law Portion for Paper 6 Integrated Business Solutions in 3 vols for CA Final 12 th edn. for may and nov 2024 examsPrice:

CA Arpita Tulsyan Hand Written Book on Company Law , Economic Laws Self Placed Online Module Set A and Law Portion for Paper 6 Integrated Business Solutions in 3 vols for CA Final 12 th edn. for may and nov 2024 examsPrice:1699.00900.00 CA Aarti Lahoti Advanced Auditing and Professional Ethics for CA Final NEW SYLLABUS 9th edn. jan 2023 in 2 modules in colourPrice:

CA Aarti Lahoti Advanced Auditing and Professional Ethics for CA Final NEW SYLLABUS 9th edn. jan 2023 in 2 modules in colourPrice:1500.00900.00 CA Final Padhuka Direct Tax By CA G Sekar May / Nov 25 ExamPrice:

CA Final Padhuka Direct Tax By CA G Sekar May / Nov 25 ExamPrice:2499.002100.00 Taxmann Income Tax Act as amended by Finance Act 2025Price:

Taxmann Income Tax Act as amended by Finance Act 2025Price:2895.002500.00 Dr. Vinod K Singhania Direct Taxes Law And Practice Professional Edn Assessment Year 2024-25 as amended by Finance Act 2024 DTLPPrice:

Dr. Vinod K Singhania Direct Taxes Law And Practice Professional Edn Assessment Year 2024-25 as amended by Finance Act 2024 DTLPPrice:4495.003500.00 Taxmann Income Tax Rules Edition 2025 it rulesPrice:

Taxmann Income Tax Rules Edition 2025 it rulesPrice:2695.002290.00 CA Final Padhuka Indirect Taxes CA G Sekar , R S Balaji May 25 ExamPrice:

CA Final Padhuka Indirect Taxes CA G Sekar , R S Balaji May 25 ExamPrice:1494.001250.00 Manoharan STUDENTS HANDBOOK ON TAXATION INCLUDES INCOME TAX LAW GOODS AND SERVICES TAX LAW ASSESSMENT YEAR 2025-26 FOR CA Inter may 2025 exams recommended by ICAIPrice:

Manoharan STUDENTS HANDBOOK ON TAXATION INCLUDES INCOME TAX LAW GOODS AND SERVICES TAX LAW ASSESSMENT YEAR 2025-26 FOR CA Inter may 2025 exams recommended by ICAIPrice:1695.001440.00 Snow White CA /CMA / CS Final Direct Tax Laws and International Taxation New Syllabus (Set Of 2 Vols ) By T. N. Manoharan, G.R. Hari Applicable for May / November 2025 ExamPrice:

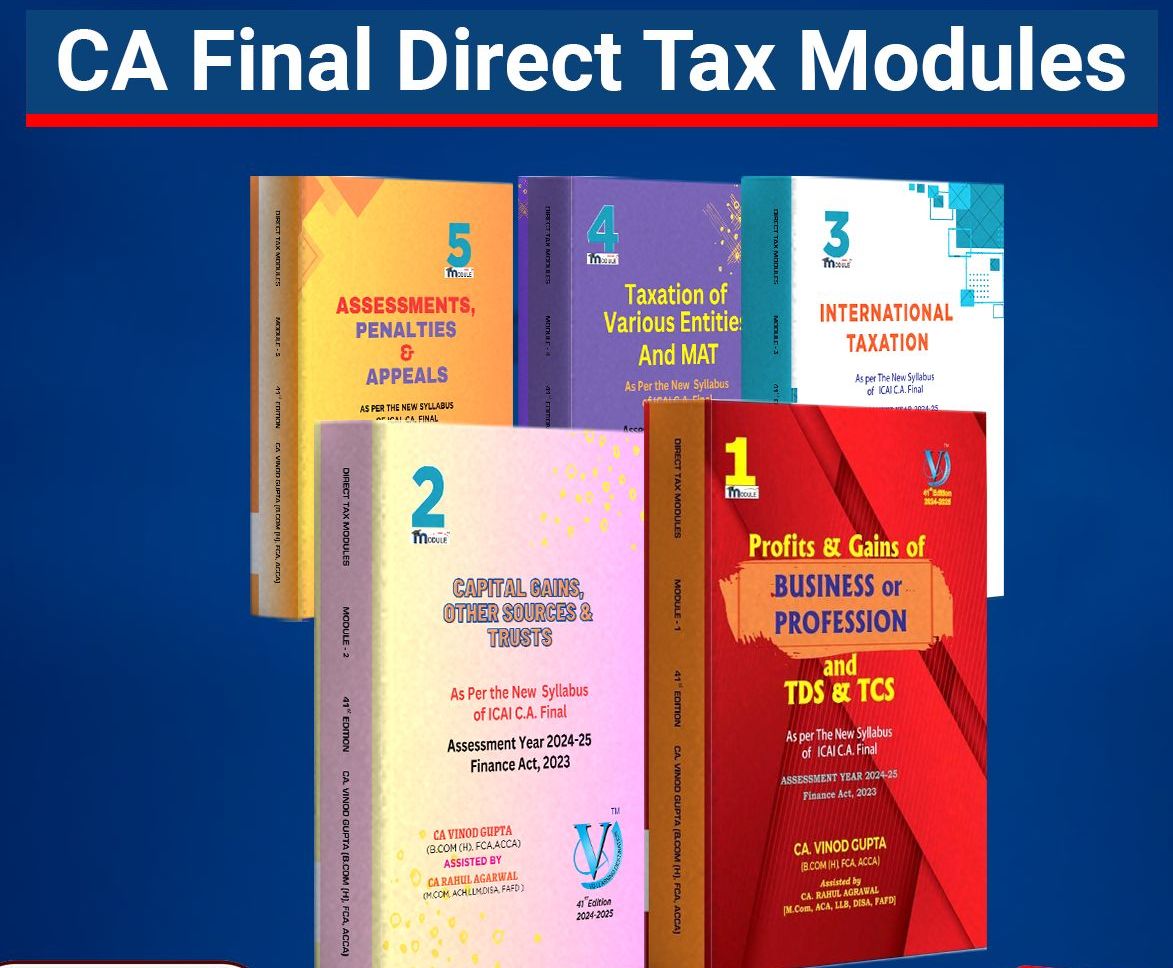

Snow White CA /CMA / CS Final Direct Tax Laws and International Taxation New Syllabus (Set Of 2 Vols ) By T. N. Manoharan, G.R. Hari Applicable for May / November 2025 ExamPrice:2295.001950.00 CA Vinod Gupta Direct Tax Modules in 5 modules for CA Final Assessment year 2024-25 Finance Act 2023 41st EditionPrice:

CA Vinod Gupta Direct Tax Modules in 5 modules for CA Final Assessment year 2024-25 Finance Act 2023 41st EditionPrice:2200.002000.00 Dolphy DSouza Indian Accounting Standards ( Ind AS) Interpretation Issues and Practical Application in 3 vols edn. 2025Price:

Dolphy DSouza Indian Accounting Standards ( Ind AS) Interpretation Issues and Practical Application in 3 vols edn. 2025Price:7995.006500.00 Commercial CA Final Padhuka Practical Learning Series Advanced Financial Management New Syllabus By G. Sekar Applicable May 2025 ExamPrice:

Commercial CA Final Padhuka Practical Learning Series Advanced Financial Management New Syllabus By G. Sekar Applicable May 2025 ExamPrice:1359.001100.00