Systematic Approach to Tax Laws and Practice for CS Executive applicable for june 23 and dec 23 exams

Taxmann Insolvency and Bankruptcy with Rules and Regulations Edition January 2023

CS Professional Compliance Management Audit & Due Diligence (CMADD/Due Diligence) | CRACKER as per new syllabus for june and dec. 2024 exams

Taxmann Cracker CS Executive Financial & Strategic Management Old Syllabus By N.S Zad Applicable for June 2024 Exams

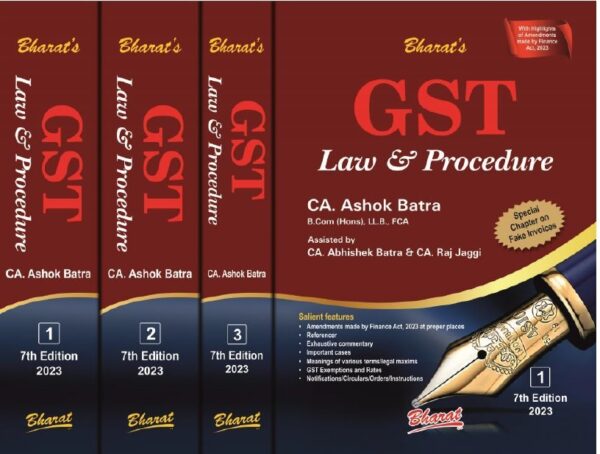

Bharat Goods and Service Tax Law & Procedure (Set of 3 Volumes) By CA Ashok Batra Edition April 2023

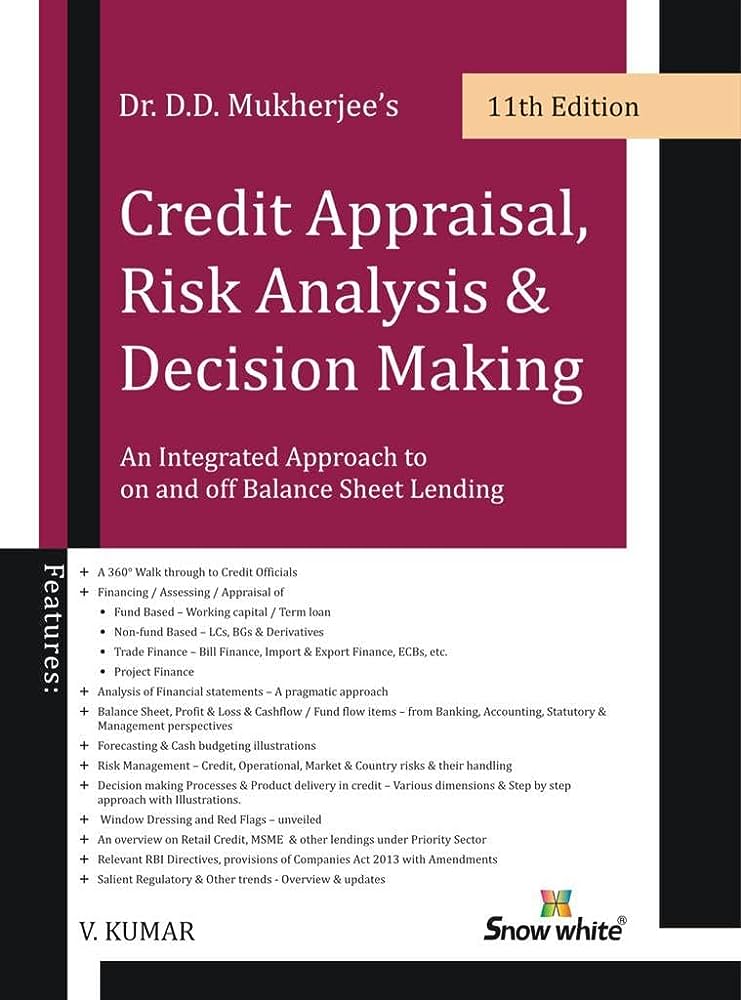

D.D.Mukherjee Credit Appraisal, Risk Analysis & Decision Making - An intergrated Approach to on and off Balance Sheet Lending 11th edn. 2023

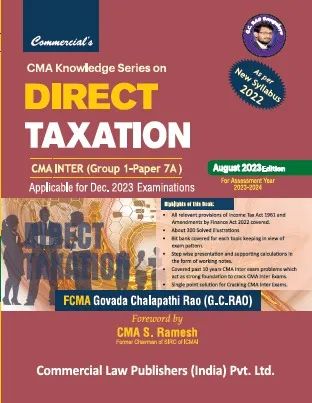

Commercial CMA Knowledge Series On Direct Taxation 2022 Syllabus for CMA Inter By G.C. Rao Applicable for December 2023 Onnwards

The Budget Guide 2022-23

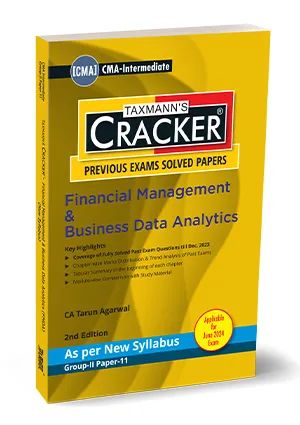

Taxmann CMA Inter Financial Management and Business Data Taxmann CMA Inter Cracker Financial Management & Business Data Analytics (2022 Syllabus) By Tarun Agarwal Applicable for June 2024 Exam

Taxmann Cracker Securities Laws and Capital Markets Old Syllabus By N S Zad Applicable for June 2024 Exam

Taxmann Insolvency and Bankruptcy Law Manual With IBC Law Guide By Taxmann’s Editorial Board Edition 2024

Bharat CA Final Indirect Taxes Containing GST, Customs, FTP & Comprehensive Issues With MCQ For New Syllabus By Mohd Rafi Applicable for May / November 2024 Exam